These items were purchased from our local symphony book sale.

Circa 1940, LC Gagnon was taken by his mother to Prescott via the CNR ... returning to Montreal's Victoria Pier on the Canada Steamship Lines steamer Rapids Prince as it travelled over the rapids of the St Lawrence.

The first undated booklet includes a map with a 1928 date and reference is made to the future opening of the Welland Canal in 1930. The river map is attached to the back cover, however it is also inserted in this post after Page 7 to make the text easier to follow.

Following this booklet is a pamphlet put out by the Richelieu and Ontario Navigation Company (1899) detailing their routes: Niagara to the Sea.

The R&ON Co was later taken over by Canada Steamship Lines in 1913 in a stock swap deal. At the time, some decried the consolidation of these shipping lines into a company whose power might approach that of a monopoly.

CSL then introduced $8 million of the intangible asset 'goodwill' to its balance sheet. This is the equivalent of $202 million today (2022).

Investors are generally told to be cautious when a company books a high value of 'goodwill'. Generally, goodwill is: The strength of a company's brand to bring in additional business ... using its tangible assets, a skilled and motivated workforce, and the company's past performance. Goodwill cannot be objectively valued. Old steamboats can, however, and there was some question about the valuations of the steamboats owned by the parent company.

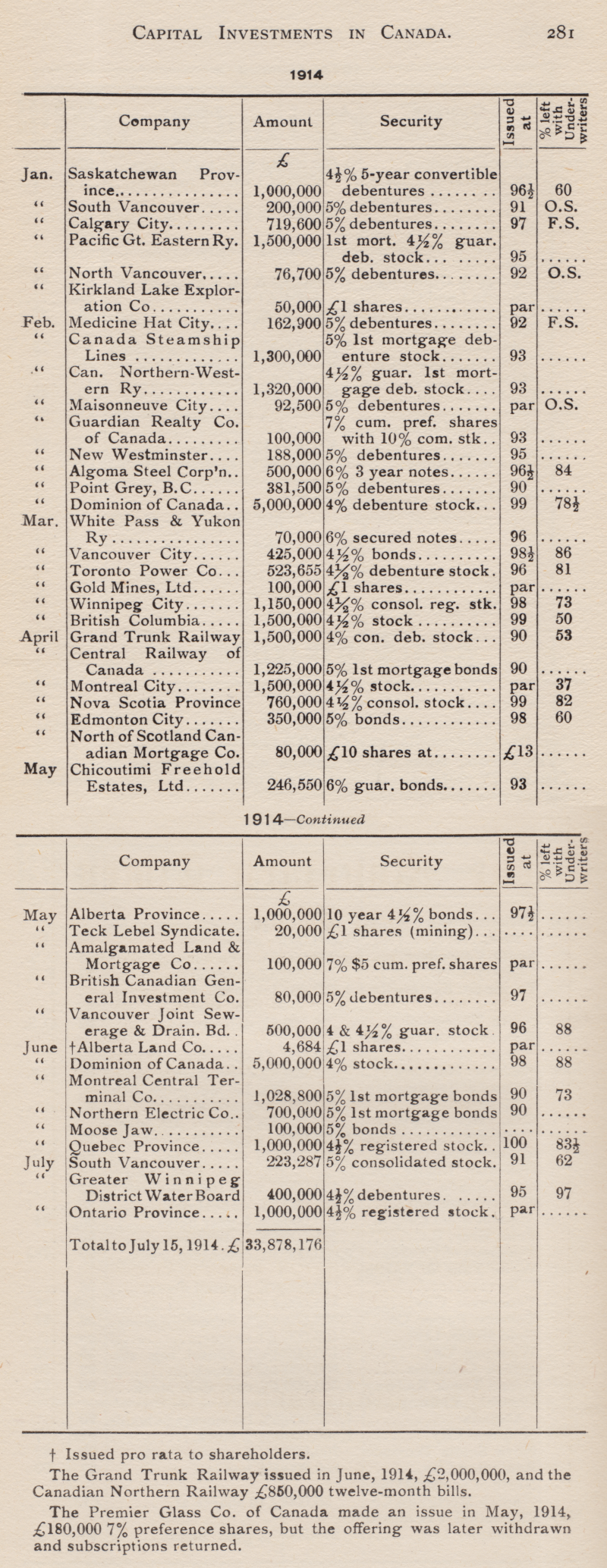

... Whether it was railway companies or steamship companies ... investors in Canadian transportation companies were well-advised to be careful as increasingly powerful steam technology opened up the country for commerce. While American investors could take a train to survey the company they were investing in, British and other European investors might get 'sold on the story' of rapidly-expanding companies like the Grand Trunk (Pacific) and the Canadian Northern. Roughly 80% of Canadian railways' common stock, circa 1910, was sold to investors in Britain, Germany and France.

Oh, look! ... in February, 1914 ... here's the post-merger CSL! ...

|

| from: Capital Investments in Canada; Frederick W Field; 1914; Monetary Times of Canada. |

If you accept that One Pound Sterling was equal to 4.87 Canadian Dollars - based on the gold standard pegs of the pre-WW1 period ... and you run the CSL issuance above through the inflation calculator ...

In February 1914, in London, England ... Canada Steamship Lines placed (borrowed) $159 million (in 2022 dollars) of its First Mortgage debentures - after its takeover of the R&NO Co with the introduction of that high goodwill value (2022: $202 million) puffing up its assets.

The securities were offered at a discount of 93/100 of face value, but the underwriters managed to place all of the issue with investors in Europe.

There's lots of 'goodwill' to go around as long as somebody doesn't start a war!

Jumping ahead to happier times at the beginning of the Dirty Thirties !

|

| from: Passage to the Sea; Edgar Andrew Collard; 1991; Doubleday. |

|

| from: Passage to the Sea; Edgar Andrew Collard; 1991; Doubleday. |

|

| from: New Album of Montreal Views, no date. |